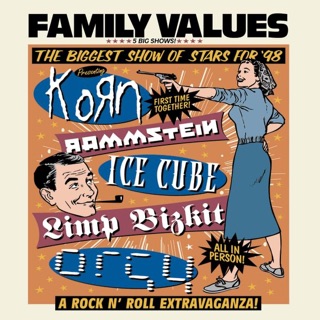

Family Values Tour (Korn, Rammstein, Limp Bizkit, Orgy, Ice Cube) [1998, Nu Metal / Rock / Rap, DVDRip - AVC] 1.77 GB Limp Bizkit - Discography / Metal / 1996-2011 / ALAC / Lossless 13.33 GB Limp Bizkit - limpbizkitmixx / Alternative / 2017 / MP3 166 MB. Family Values existed as a tour from 1998 to 1999, again in 2001, from 2006 to 2007, and then as a one-off festival in 2013. Subscribe to Metal Injection on Related Posts.

'Actually, we went to Australia and Japan. It was amazing. We played Download Festival with Prophets Of Rage And then we played in Japan a few shows. So now we're taking time off. We're writing more music.

We're doing only four shows this year in America. Three L.A., Vegas, San Francisco—that's it. We've got some plans to resurrect some cool tour plans next year, 2019. But it's cool to have time off.” The prevailing assumption as to what these 'cool tour plans' are is that Korn is bringing back the Family Values Tour. Davis mentioned it last month, and the tour has been gone long enough to where a resurrection would be in order. Family Values existed as a tour from 1998 to 1999, again in 2001, from 2006 to 2007, and then as a one-off festival in 2013.

Ebook mikro ekonomi pdf. EMusic Today, online music retailer eMusic announced a deal with Universal Music Group that will bring 250,000 new songs to its catalog starting in November. Along with the expanded catalog, the retailer will begin displaying song and album prices in dollar values, instead of the obscure credits system that has been in place for years. These changes are part of a larger effort by eMusic to bring the service and its music catalog in line with the big guns of Apple and Amazon. After in August (Adam Klein), the company has been working to swiftly add all the major labels to its extensive, predominantly indie music catalog. Even with the addition of recent releases from UMG, there are still gaps in the eMusic catalog.

The big fish eMusic still needs to reel in is EMI, though there is reason to believe a deal will be finalized by the November relaunch. Historically, major labels have been resistant to license songs to eMusic out of fear that the lower prices offered by the retailer would devalue their music. Songs sold using eMusic's unique DRM-free subscription system are typically sold at a 40-percent to 50-percent discount compared to iTunes or Amazon. As a concession to labels, eMusic's new pricing system allows for finer control over pricing, so new or popular content can be priced at a premium. Previously, eMusic subscribers were given a monthly allotment of song credits, guaranteeing a set number of downloads each month. Under the new system, subscribers are charged the same amount, but shown their monthly allotment in dollars. Songs are priced individually between $0.49-$0.89, with albums priced between $5.19-$8.99.

The fundamental value of eMusic remains the same, though, with $0.49 songs representing a 50-percent savings over a $0.99 iTunes song, or an $0.89 song saving users approximately 20 percent compared to the $1.29 price on iTunes. The company's switch to pricing in dollars also opens the site to better indexing by search engines, such as Google. A sample album page on eMusic. EMusic These changes may seem minor and arguably long overdue, but they have the potential to put eMusic back in the game as a more aggressive contender to iTunes and Amazon. The most common complaint I hear about eMusic is the difficulty in finding popular music and artists.

Otherwise, the retailer's, emphasis on community and staff reviews, curated playlists, and championing of great indie music, makes it a haven for serious music fans. Unfortunately, without marquee albums and artists available, even eMusic's most devout users have been forced to buy some of their music elsewhere. The rest of us are just left questioning the value of a bulk discount music service stocked with music we've never heard of. By making the catalog more competitive with Apple and Amazon, eMusic has the chance to finally cash in on the potential it's been sitting on since 1998.